OpRisk Modeling, management and capital requirements dermination

Operational risk modelling, management and capital requirements determination

In addition, Chartis Research’s Enterprise GRC Solutions, 2019 classified AnalytiX Boutique as:

- Best of Enterprise Solutions in GRC Analytics Quadrant

- Best of Breed on the Quadrant of OpRisk & Conduct Risk

- Best of Enterprise Solutions in Model Risk Governance Quadrant

In addition, OpCapital Analytics methods (including operational risk capital modelling) are widely published and our publications recognised by top practitioners (see Actuary Magazine and RiskBook).

Download AnalytiX Boutique application brochures:

AnalytiX Boutique differential value proposition using Modelio.OpCapital in GRC is breaking the “bubble chart” paradigm by strong operational risk modelling and analytics. By the “bubble chart” paradigm we mean that GRC output should no longer be limited to nice dashboards of GRC basic metrics (i.e., loss collection, indicators, risk evaluations…). These GRC basic metrics are hard to understand by senior and upper management and too frequently end up ignored and not effectively integrated into daily management due to their unclear monetary value. Using operational risk modelling techniques (distribution models, forecasting models, correlations, Monte Carlo…), our solution transforms GRC basic metrics into GRC monetary value metrics (i.e., how much does risk cost, how much can be saved, NPV of risk mitigation investments, capital requirements…). Monetary metrics are the language senior and upper management understand and use daily. GRC metrics translated into monetary value can easily be integrated with the standard risk management processes: planning, budgeting, resource allocation, and so on.

Hence, the influence of the operational risk management function into the organization is maximised.

Our operational risk capital system, Modelio.OpCapital can be used for the following purposes:

- Collect scenario analysis

- Determine the money value of Risk and the NPV of mitigation actions

- Collect loss events and KRIs

- Operational risk modelling

- Manage mitigation plans and build their business case to justify required investments and insurance premiums

- ICAAP and ORSA Operational Risk stable and robust capital estimates

- Comply with ISO31000

- Risk and control mapping

Scenario Analysis

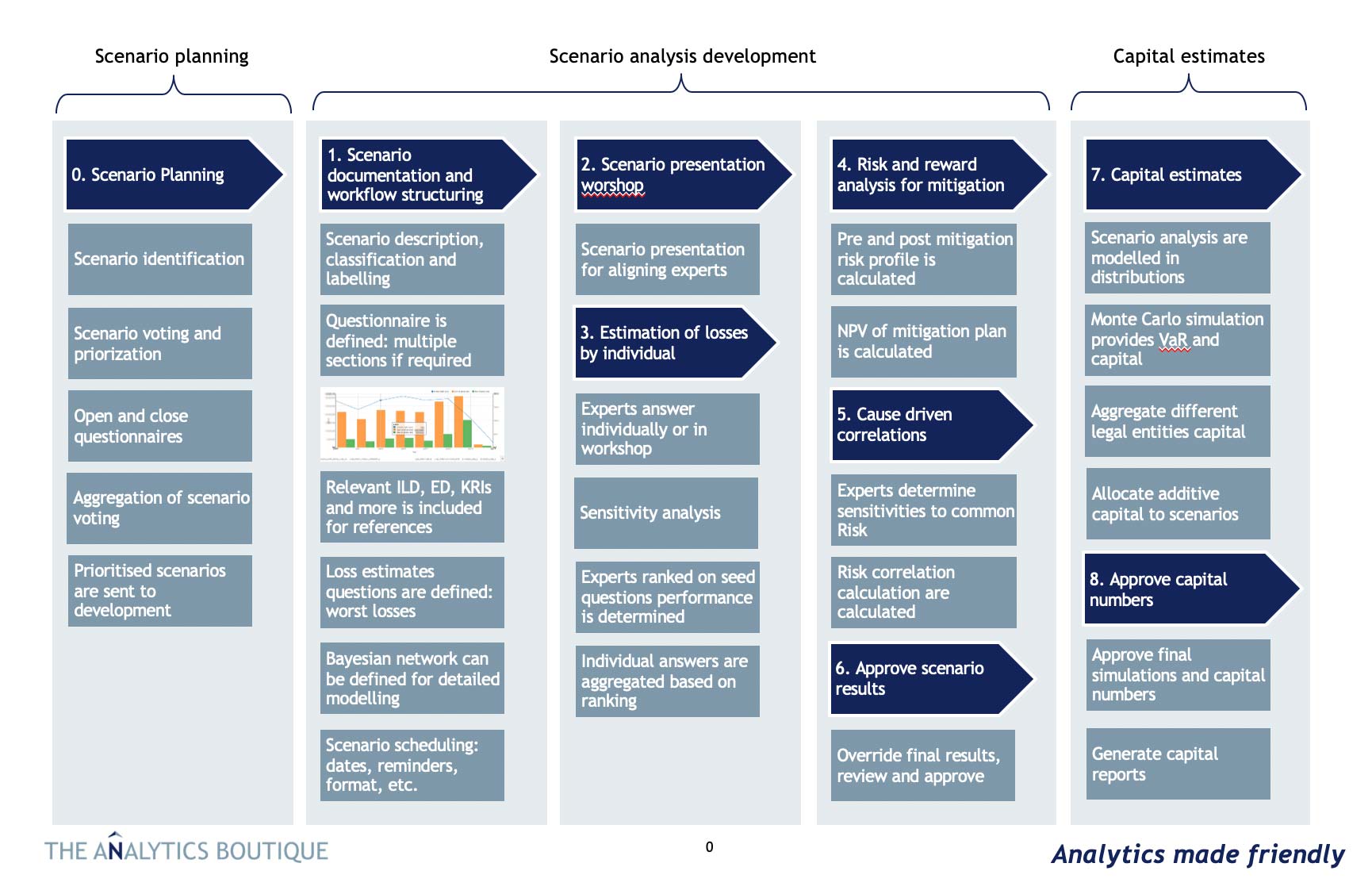

Scenario analysis is a fundamental tool for operational risk modelling. Our operational risk capital solution, OpCapital provides the following benefits, see Structured Scenario Analysis:

- Great efficiency and strong model governance: workflow, approvals, complete audit trail, workshop invites, automatic reminders, answer aggregation, report generation and more

- Cognitive bias mitigation permitting a high-quality operational risk capital modelling: Group thinking, herding, authority bias, confirmation bias and others

- Scenario planning and identification of most relevant scenarios for operational risk capital

- Priority scenario detailed development

- Scenario support data in questionnaire including case studies, to support experts when answering

- Possibility to answer form in workshop or, alternatively, answering each expert individually and aggregating individual answers into a single answer per scenario

- Evaluation of risk scenarios under any number of dimensions: ie, financial, reputational and operative

- Scenario scientific validation of qualitative estimates of risk using Structured Expert Judgment

- On-the-fly operational risk modelling and Monte Carlo simulation for estimating loss profile by the first line of defence

- Audit trail of origin and all transformations in the scenario down to the simulation report

- Extensive model regulatory approval reporting

Scenario analysis is a fundamental tool for operational risk modelling. Our operational risk capital solution, OpCapital provides the following benefits, see Structured Scenario Analysis:

- Great efficiency and strong model governance: workflow, approvals, complete audit trail, workshop invites, automatic reminders, answer aggregation, report generation and more

- Cognitive bias mitigation permitting a high-quality operational risk capital modelling: Group thinking, herding, authority bias, confirmation bias and others

- Scenario planning and identification of most relevant scenarios for operational risk capital

- Priority scenario detailed development

- Scenario support data in questionnaire including case studies, to support experts when answering

- Possibility to answer form in workshop or, alternatively, answering each expert individually and aggregating individual answers into a single answer per scenario

- Evaluation of risk scenarios under any number of dimensions: ie, financial, reputational and operative

- Scenario scientific validation of qualitative estimates of risk using Structured Expert Judgment

- On-the-fly operational risk modelling and Monte Carlo simulation for estimating loss profile by the first line of defence

- Audit trail of origin and all transformations in the scenario down to the simulation report

- Extensive model regulatory approval reporting

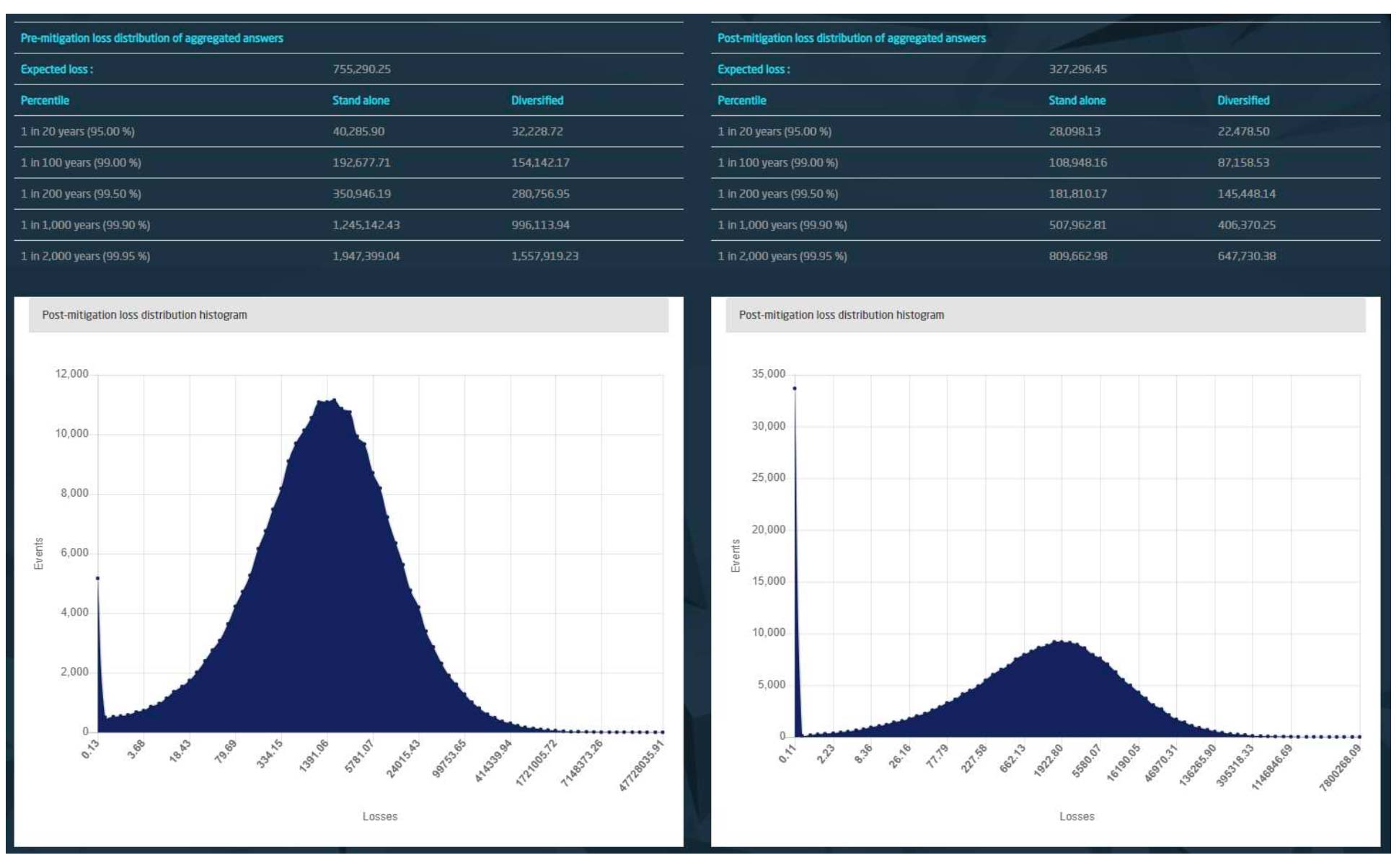

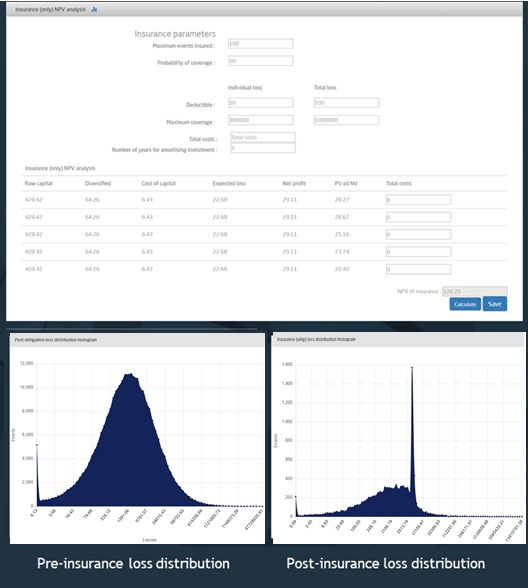

Action plans are critical for the management and modelling of operational risk and for obtaining a forward-looking estimate of operational risk capital. Our operational risk capital software, OpCapital Analytics, provides the following benefits:

- Action plan management documenting responsibles, reminders and alerts

- Simulation of action plan NPV for building business case for required investments

- Simulation of the impact of insurance policies permitting the detailed modelling of insurance features and calculating the NPV of insurance policies and their impact in operational risk capital

- Combination of insurance with action plans to determine the total mitigation in the risk profile and resulting NPV and corresponding impact in operational risk capital

- Operational risk modelling of all the above metrics

Pre and post mitigation action loss distributions and operational risk capital

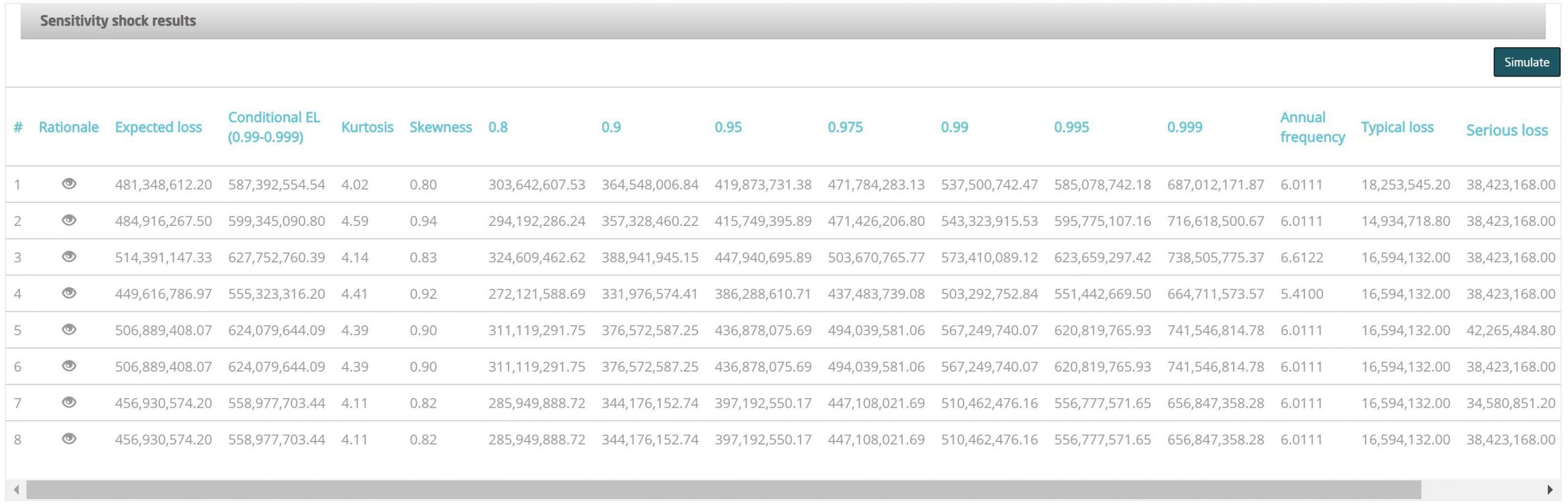

A robust operational risk capital calculation requires a solid validation of assumptions which can be done by sensitivity analysis. Sensitivity analysis provides the impact on operational risk capital of changes in the underlying modelling assumptions. Our operational risk capital software, OpCapital Analytics, permits the following:

- Automatically generates pre-defined sensitivity shocks for the scenario loss estimates

- Permits scenario ad-hoc sensitivity shocks

- Allows sensitivity analysis on distribution law assumptions

- Automatically calculates sensitivity analysis operational risk capital results through operational risk modelling

- Sensitivity analysis operational risk capital report

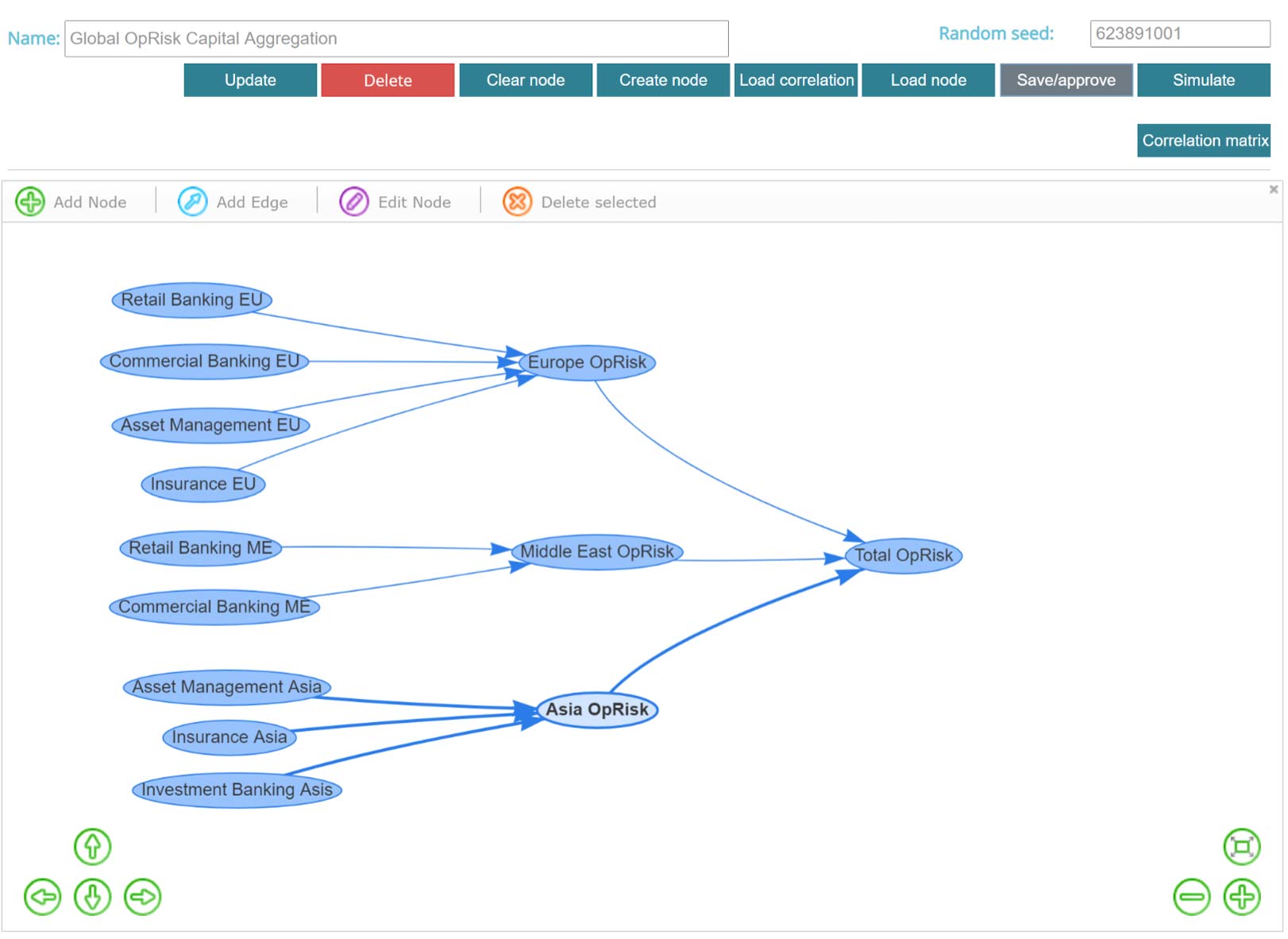

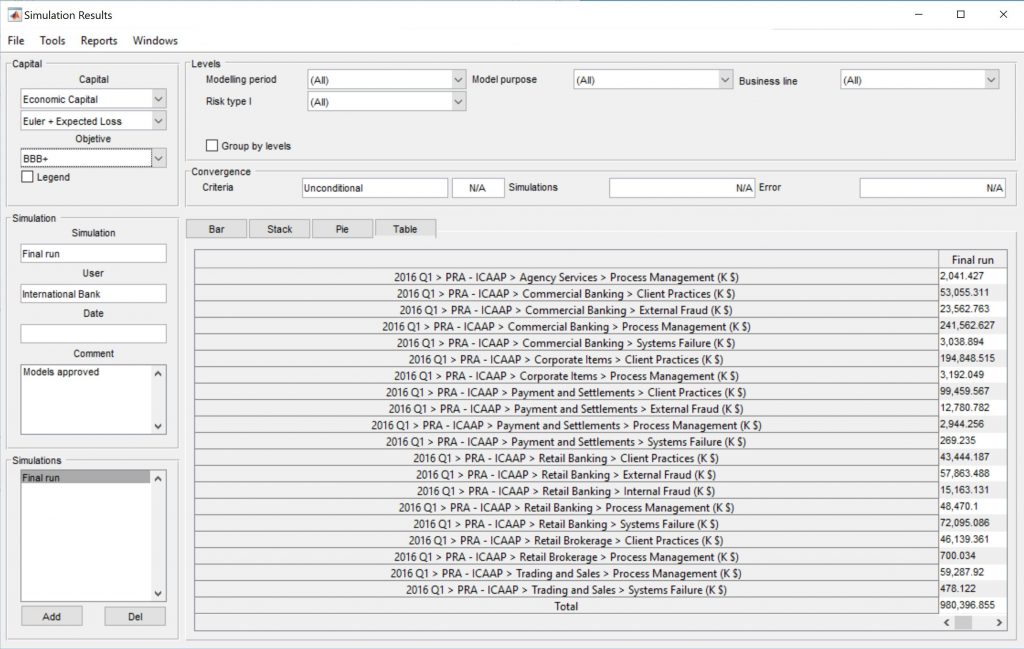

The calculation of operational risk capital requires the consideration of many ORCs (operational risk categories) which requires multiple phases for their aggregation into a single figure of operational risk capital. Our operational risk capital solution, OpCapital Analytics, helps in the following way:

- In case of very large number of scenarios simulation, it is possible to aggregate scenarios using flexible aggregation paths in multiple steps

- Each aggregation node permits the definition of a specific correlation matrix

- Total capital is allocated down to all steps providing allocated capital to scenarios

Operational risk capital is largely determined by the impact of a reduced number of highly damaging scenarios which deserve a more detailed attention and modelling. OpCapital provides the means to model scenarios using Bayesian Networks:

- Most damaging scenarios or those in need of expensive mitigation plans can be modelled using our Bayesian networks user friendly and highly flexible capabilities

- Results are integrated into the hybrid model together with the rest of scenarios or even LDA models

- Bayesian network provides the pre-and post-mitigation analysis and the mitigation plan NPV, including insurance impact, in consistency with the rest of modelled scenarios

- Bayesian networks approach is integrated with the rest of the workflow and governance framework: audit trail, permissions, aggregation and overwrite phases, reporting, etc.

Loss data and indicators are a valuable input into operational risk capital determination. OpCapital provides the following features:

- Customizable loss and indicators collection forms

- Unlimited number of collection processes for losses and any other indicators

- Customised indicator (KRI, KPI, KCI…) collection workflows with reminders and alerts for faulty collection

- Customization of indicator collection frequency and responsibles

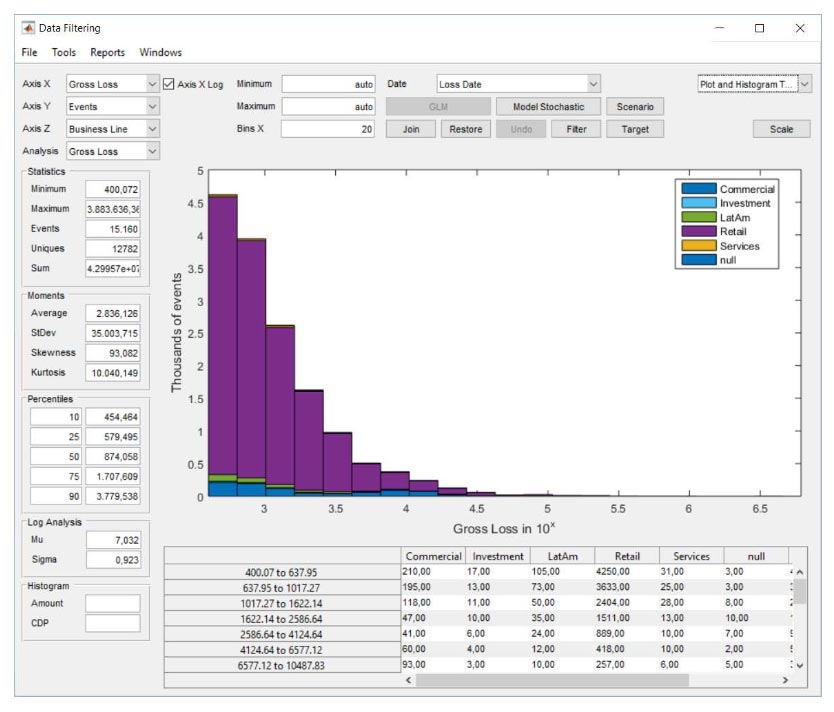

Analysis of operational risk data is a fundamental step in the modelling of operational risk capital permitting the definition of the correct modelling sample. Our operational risk capital solution, OpCapital provides the following features among many others:

- Multiple incident management modules activated simultaneously

- Multiple visual representation and analysis

- Audit trail of all transformations, filters, etc., introduced in data

- Audit trail of the data origin, filters and transformations which goes down to simulation report Frequency projections

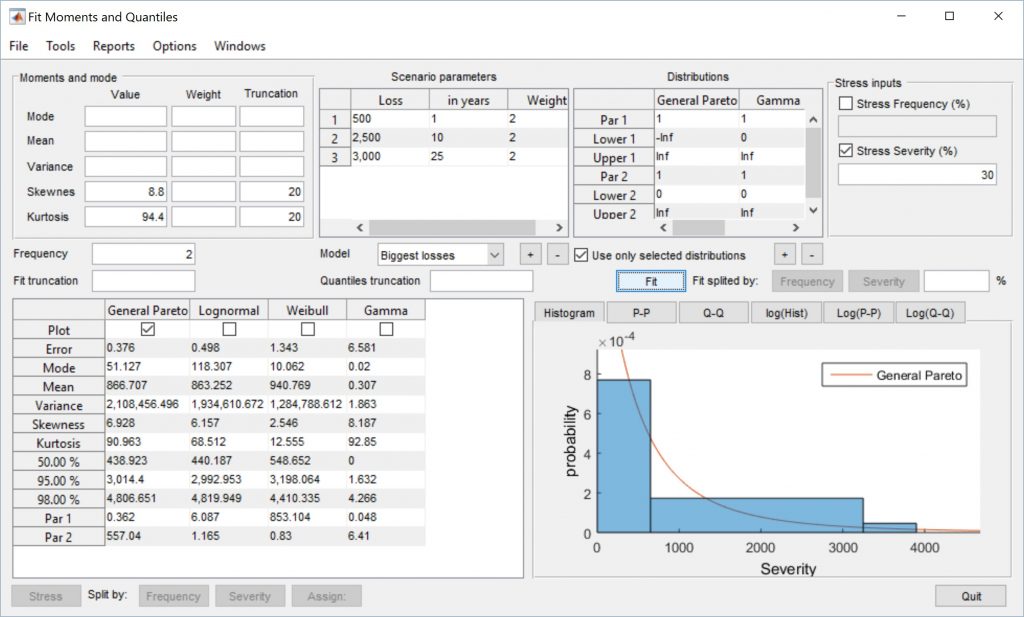

The modelling of probability distributions is needed to interpolate and extrapolate out of the observed losses and to calculate the loss percentiles that determine operational risk capital system. Our operational risk capital software,OpCapital provides the following features among many others:

24 basic severity and frequency distributions

24 basic severity and frequency distributions- Mixtures of any combination of basic distributions

- Simulations, fitting and comparison of all fitted distributions

- User defined distributions via XML

- Fitting via MLE, Robust Least Squares, Probability Weighted Least Squares, Probability Weighted and Moments approach

- Distribution split in 3 segments (low losses, medium losses and tail losses)

- GoF: AD, KS, Kramer von Mises, etc.

- GoF visual: PP and QQ plots, histogram and CDF

- Non parametric distributions

- Highly efficient operational risk modelling operational risk modelling

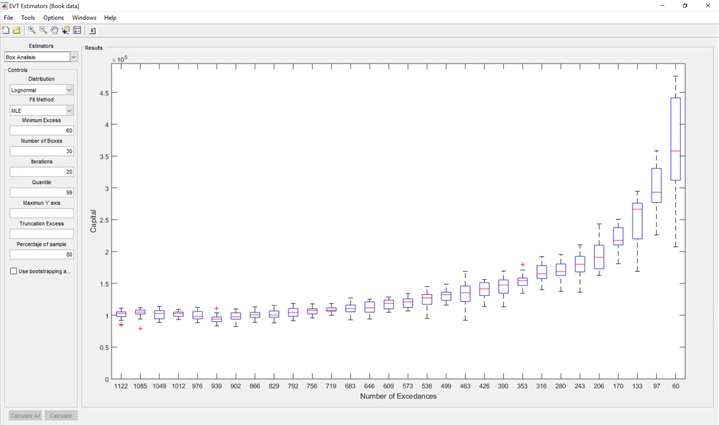

Operational risk capital is mostly influenced by loss distribution tails which are better modelled using Extreme Value Theory (EVT). Our operational risk capital solution, OpCapital provides the following EVT analysis to maximise the quality of operational risk modelling:

- DEdH analysis

- Tail parameter stability analysis by threshold

- Tail plot

- Mean Excess Plot

- Hill estimator

- HKKP-Hill

- GoF analysis by threshold

A complete modelling of operational risk capital requires the accommodation of multiple loss types characterised by their loss frequency and criticality of the loss: high frequency and low frequency ORCs are worth modelling in detail using Bayesian networks; other ORCs are not worth the detailed operational risk capital modelling effort. Our operational risk capital system’s hybrid model accepts all cases for a comprehensive and adapted to the ORC characteristics and complete OpRisk modelling:

- Internal Loss Data for high frequency risk categories

- External Loss Data complementing tails

- Scenario analysis based on direct loss estimates

- Scenario analysis modelled in detailed using Bayesian networks, for those most critical scenarios

Finally, the operational risk capital figures are generated using Monte Carlo simulation. OpCapital provides multiple features including the followings:

- Copula parameters fitting: Gaussian and t-student

- OpRisk correlations calculation and stress testing

- Nested copulas for the aggregation of multiple scenarios, data cells, etc.

- Automatic stop when stability of results is reached

- Audit trail report

- Batch process for multiples consecutive runs with different parameterizations

- Simulation in multiple currencies for multinational institutions

- Allocation of operational risk capital to its drivers

Insurance policies may or may not have a significant impact into the operational risk capital figures. OpCapital provides the means to model in detail the clauses of the insurance policy and test their real impact into the operational risk capital and expected loss, including:

- Modeling deductibles

- Modeling maximum coverage

- Applying deductibles and coverage for total losses or/and individual incidents

- Calculation of pre and after insurance operational risk capital figures

- Number of incidents covered by the insurance policy

- Other

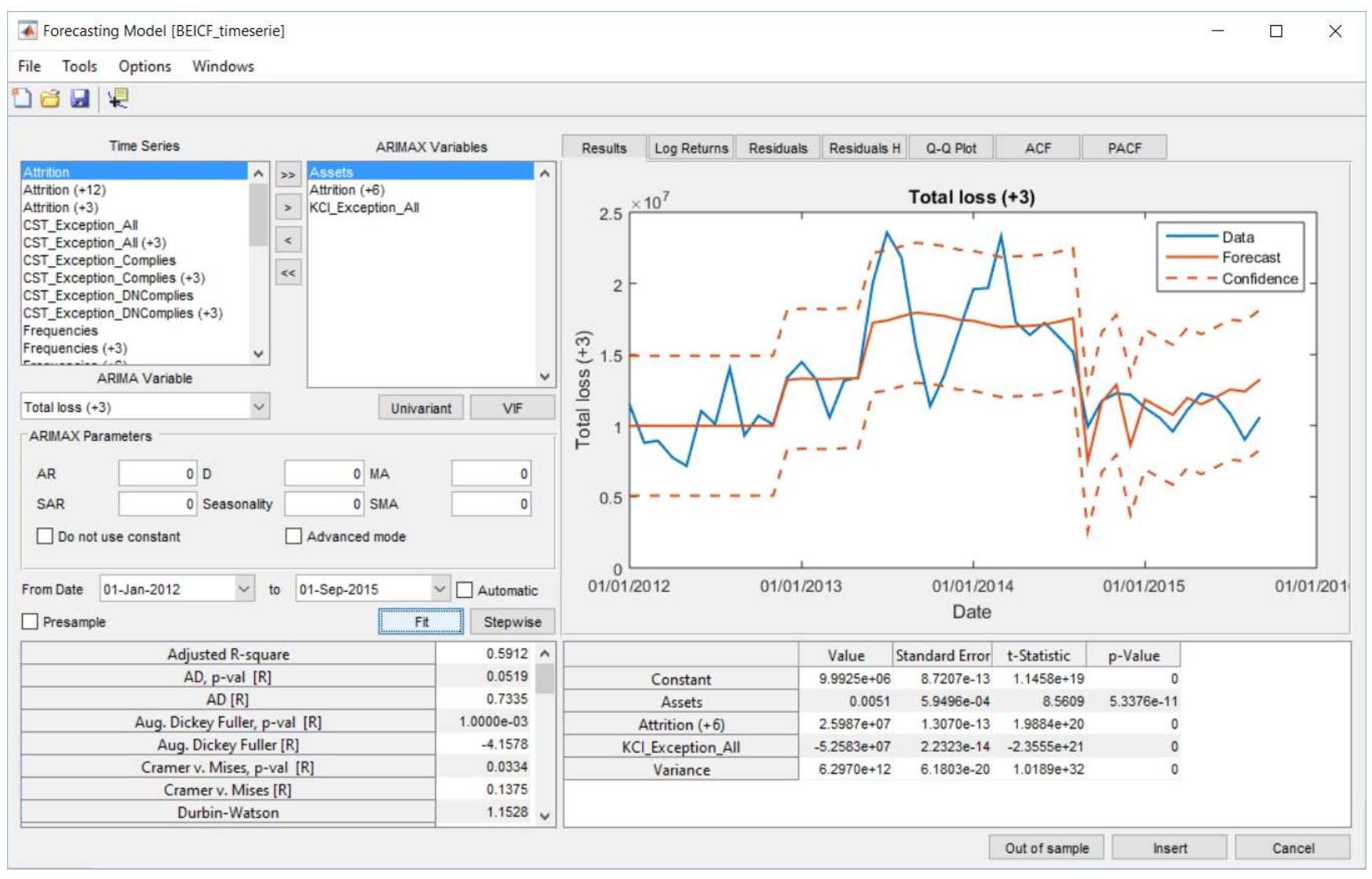

ICAAP and ORSA operational risk capital final figures take stress testing analysis as an input. Our operational risk capital system, OpCapital provides the means for creating operational risk stress testing models including the following;

- Time series loss forecasting models (ARIMA, ARIMAX and others)

- Possibility to build operational loss forecasting models based on macroeconomic data or any other indicator (KRI, KPI, KCI…)

- Projectionof operational losses under macroeconomic scenarios or under indicators scenarios, i.e., loss budgeting in case of attrition growing 20%

- Strong times series model out of sample validation features

- Modelling archive

- Extensiveregulatory validation reporting

- The loss forecasting module is a needed piece for a complete operational risk modelling

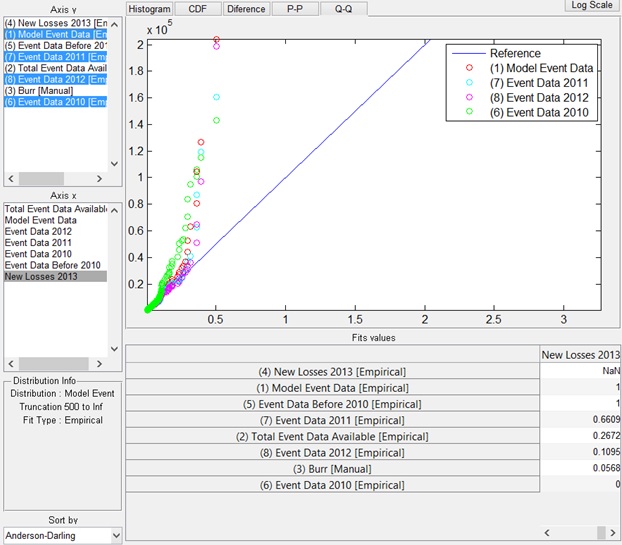

Operational risk capital needs to be backtested for validation purposes. OpCapital system provides the means for backtesting:

- QQ and PP plotscomparingnew losseswithdistributionsusedin capital estimates

- GoF statisticscomparingnew losseswithdistributionsusedin capital estimates

- Backtesting provides a required quality check in operational risk modelling

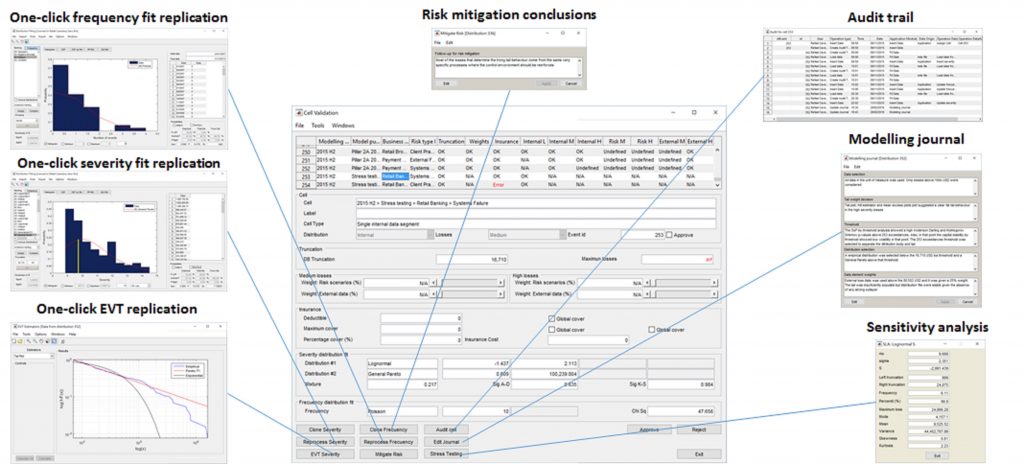

Most time-consuming tasks in operational risk capital modelling is the reporting to internal validation and regulators. OpCapital permits the generation all these reports effortlessly:

- All graphics, tables and analytics have the corresponding report: Incident data analysis, Distribution fitting, EVT, etc. that were used into the operational risk capital model construction

- Operational risk capital model regulatory approval report

The maintenance, validation and documentation of the operational risk capital is greatly enhanced when supported by formal functionalities in our operational risk capital software such as the following:

- Audit trail

- User control

- Interface with GRC software to import events, scenarios, user rights, etc.

- Interface via ODBC drive

- Handling of multiple currencies

- Parallel computing for simulation

- One click model replication

- Modelling journal

- Modelling archive

- Operational risk capital results archive

¡Let´s set your demo up!

Please fill out this form, fields with * are not optional.