ACCELERIS Loan Pricing

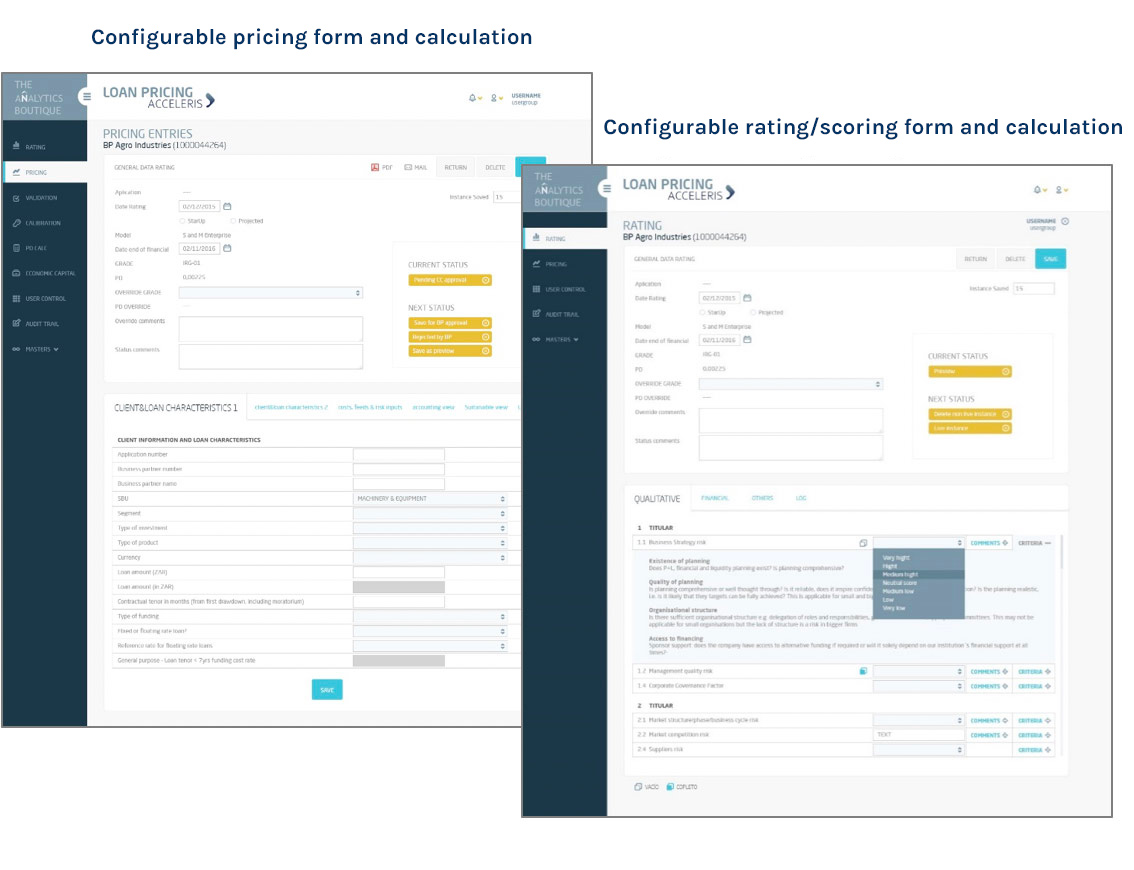

ACCELERIS Loan Pricing enables a fully audited and efficient process for loan risk-based pricing. It has also the functionality to calculate the borrower’s credit creditworthiness with its rating/scoring grade and corresponding PD as well as LGD with collateral evaluation when required. Then, the loan price is accurately calculated based on the credit risk costs (PD, LGD, EAD, capital), cost of funding, operating and administrative costs and detailed transaction characteristics as well as any adjustment to market condition and competition (contact The Analytics Boutique for a demo and commercial details).

ACCELERIS is built to comply with regulations such as EBA’s GUIDELINES ON LOAN ORIGINATION AND MONITORING and similar regulations in other jurisdictions.

The main features provided by ACCELERIS are:

- Accurate loan risk-based pricing and IFRS9 considerations

- Transaction and client relationship profitability analysis (EVA, RAROC, RORWA, RORAC, ROTA and others)

- Assessment of borrower’s creditworthiness (Rating/scoring)

- Loan creditworthiness scenario analysis engine

- Monitoring

- Internal governance for credit granting

Download ACCELERIS Loan Pricing application brochure.

Accurate Loan Risk-Based Pricing

- Credit risk costs including rating, PD (TTC/PiT), LGD, expected loss (ECL/IFRS9) and economic capital/regulatory capital

- IFRS9 considerations: PDs and expected losses resulting from IFRS9 reserves

- Transaction characteristics: ACCELERIS permits a cash-flow projection customised to each product specific features including commissions, interest payments (fixed vs. variable, reference IR and other), amortization schedules, withdrawals, collaterals, guarantees and any other product characteristic. It based on the life of the product. This permits to create a specific modelling for almost any product (i.e., credit lines, export credit letters, leasing, Real Estate finance, promissory notes, guarantees, factoring and so and so forth). It is even possible to model cash-flow for multi-products bundled into the same marketing offer

- Funding costs: ACCELERIS permits customised funding costs allocation based on client criteria and methodology

- Immovable or movable collateral: collateral value, corresponding LGD, haircuts and schedules of any kind of collateral or guarantee

- Commissions’ flexible module: ACCELERIS contains a module to model multiple features of commissions allowing a precise cashflow projection from each facility commissions, assuming one or many commissions per product

- Operating and administrative costs: as calculated by the institution and allocated to each product or transaction characteristics

- Competition and prevailing market conditions: ACCELERIS permits to compute the pricing based on a target profitability/hurdle rate or, alternatively, calculate the implicit transaction profitability (EVA, RAROC…) based on a target pricing allowing to adjust the pricing while understanding the profitability implications

Transaction and client relationship profitability analysis

- Multistep profitability metrics: EVA, RAROC, RAROC, RORWA, ROTA, spread analysis and other are calculated over the life of the transaction and are reported on annual basis for each period and on a cumulative basis

- Transaction structuring impact analysis: as additional collateral, guarantees, insurance, cross selling or other is added to the transaction, the profitability analysis can be recalculated for the profitability impact evaluation

- Facility vs. client profitability: ACCELERIS can provide multiple profitability views including a stand-alone transaction, application which may include multiple facilities and the client and/or group profitability view. It is possible to calculate the contractually secured cash-flows profitability or the assume the renewal of existing facilities to project the profitability into the future. Using the client profitability view it is possible to assess the appropriateness of a low profitability transaction to support a client relationship

- Ex-post profitability analysis: the facility, application, client or client group profitability can be analysed after approval given any potential changes in rating, expected recoveries, or other variables used for pricing

- Optimization of transaction terms: ACCELERIS permits to optimise (e.g. break even) the spread, commissions, collateral or any other facility feature in order to achieve a minimum target profitability

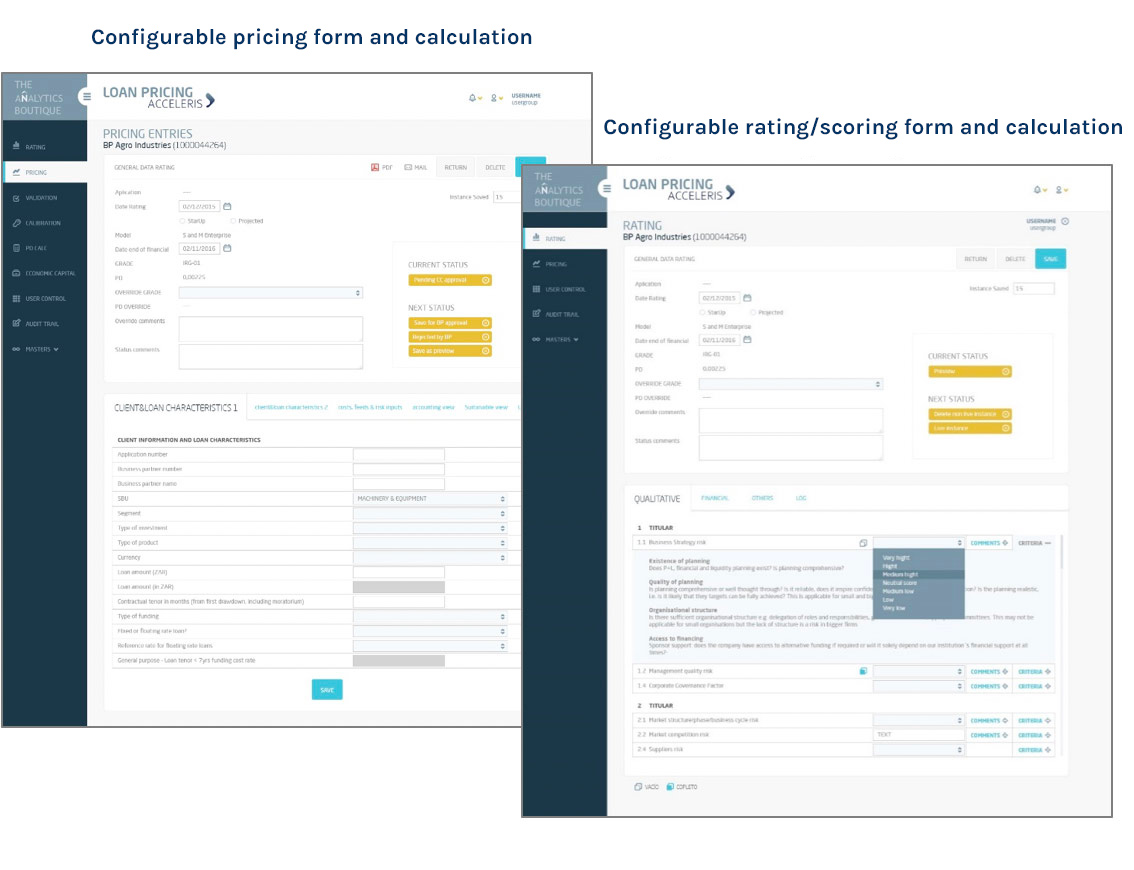

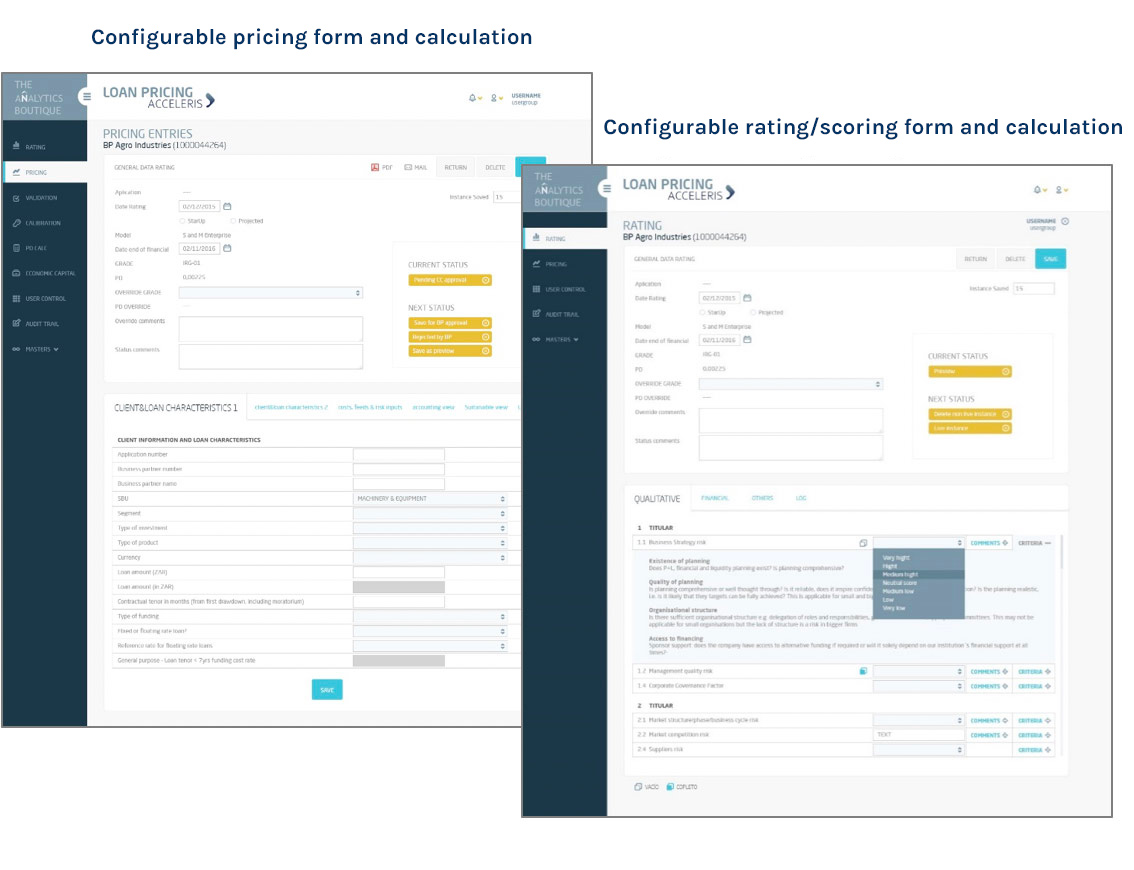

Assessment of borrower’s creditworthiness (rating/scoring)

- Predefined proprietary rating models (optional)

- Any type of client: individuals, micro-companies, SMEs, corporates, financial institutions and more

- Any industry: agriculture, services, manufacturing, Real Estate developers, and others

- Rating dimensions: qualitative, financial, other numerical data and more

- Spreading tool for financials and others

- Non financials considerations: environmental, social, industrial and economic development questionnaires

- Warning signals and overides

- Risk analytics: calculation of Probabilities of Default term profile

- Strategy: rating process can be defined for efficiency lending or to deep analysis with strong governance and anything else in between

- Loan instruction documents storage and management: financial statements, property titles, identification, others, as defined by user

Loan creditworthiness scenario analysis engine

- Definition of macroeconomic or business scenarios: based on the rating model inputs, it will be possible to define multiple scenarios and re-rate each loan of the portfolio under such scenario to easily analyse the impact of the scenario. The definition of the new scenarios will be done by defining flexible rules to transform original rating inputs into the new rating inputs

- Revaluation of the portfolio under the new scenarios: all portfolio assets will be revaluated under multiple defined in an automatic manner and be available for the analysis

- Strong analytics the impact in the portfolio health of the different scenarios will be easily analysed permitting a deeper understanding of portfolio for the purposes of informed management actions

- Reporting: ACCELERIS robust reporting features will be available for the analysis and report generation of the portfolio simulation engine

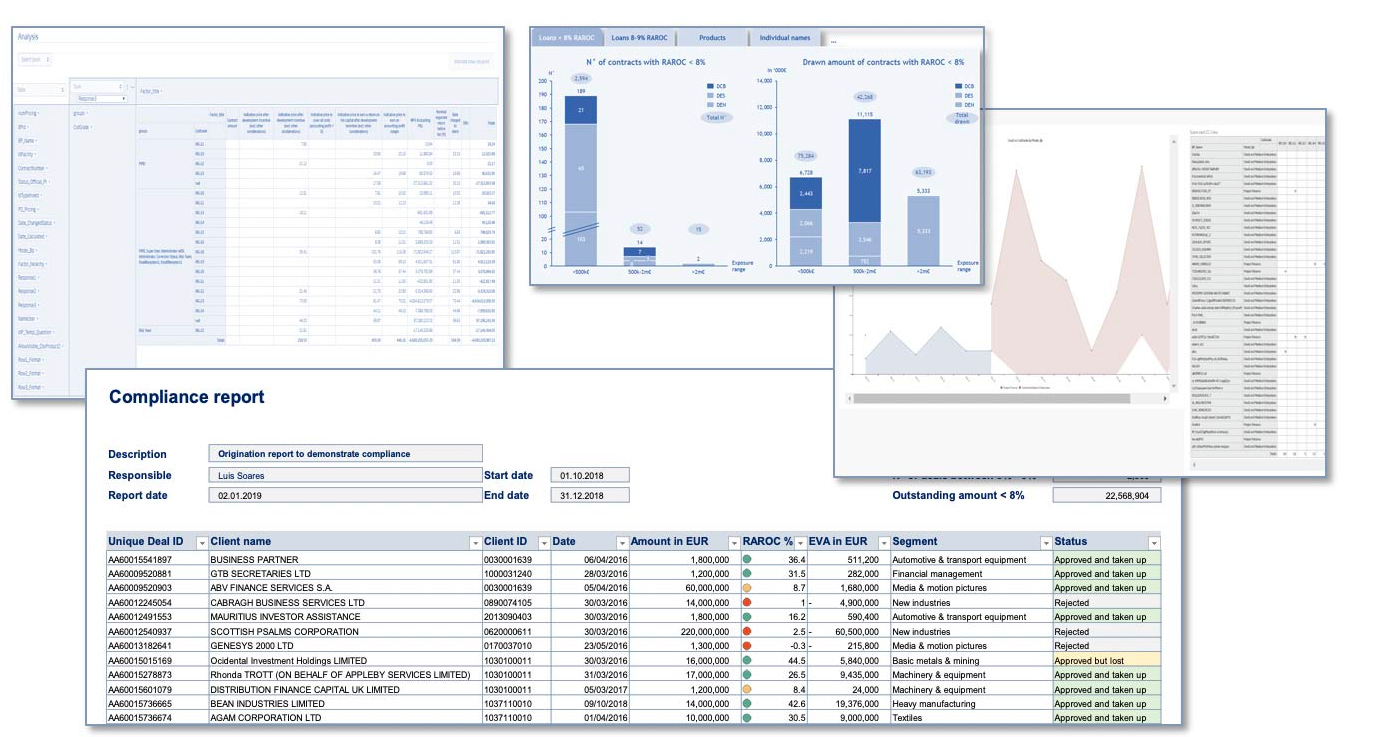

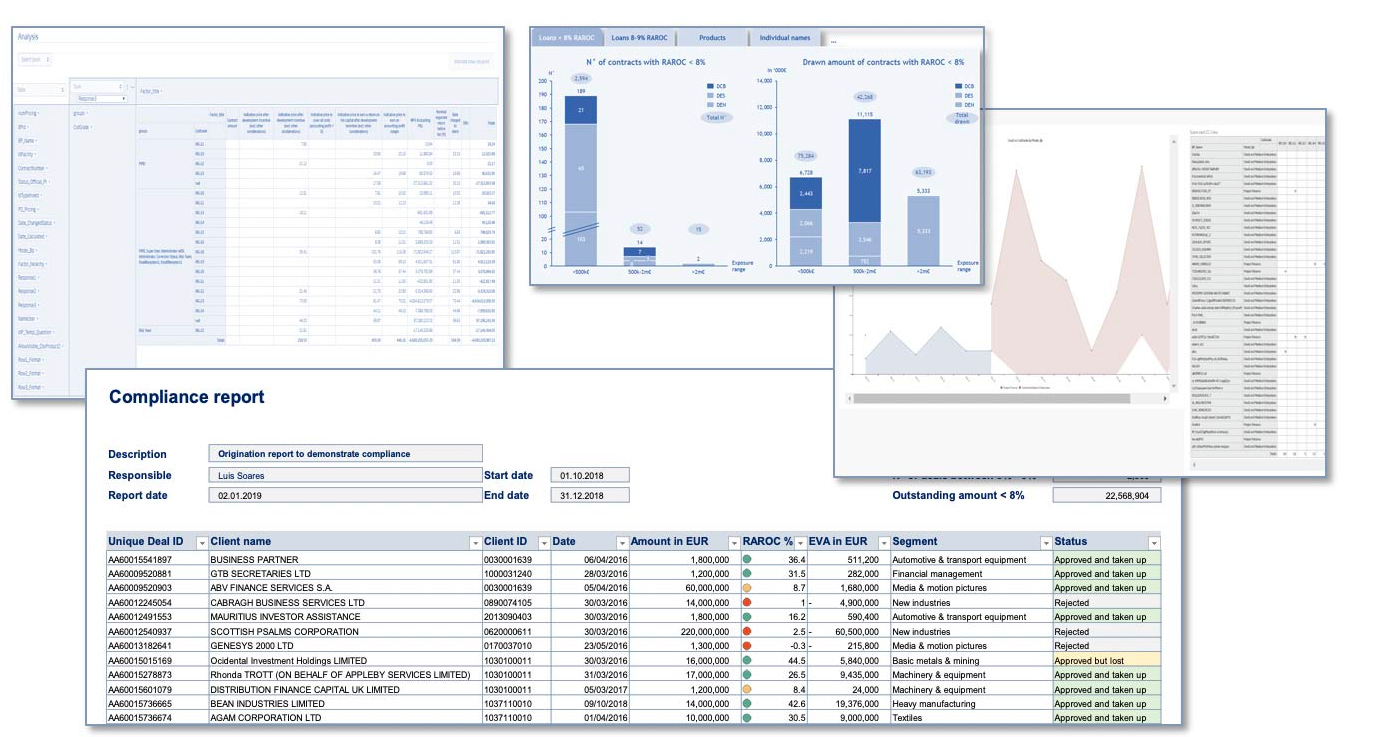

Monitoring

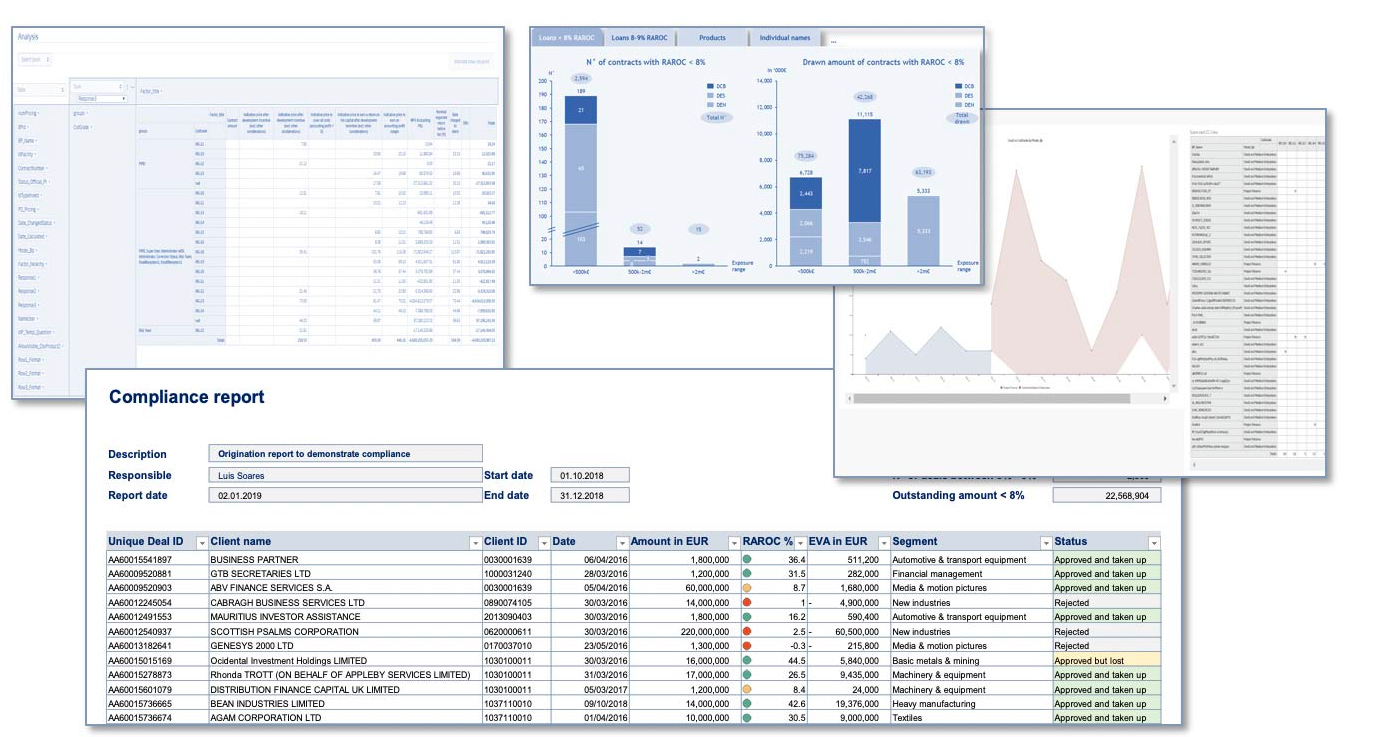

- Create custom made dashboards

- Pivot table interactive flexible reporting

- Multiple predefined dashboards:

- Strategic reporting: portfolio composition, portfolio growth and so on

- Staff performance: Number of clients rated by analyst and/or department and number of loans priced by analyst and/or department, times and so on

- Process efficiency: Derived from the time and date of each change in the workflow, it is possible to measure time consumed by staff, group, phase and so on, and identify bottle necks in the processes

- Portfolio profitability analysis: expected loss, NPV, average RAROC or any other calculated metric, understand ex-ante and ex-post results

- Exception reports: loans applications, responses, pending re-rating are overdue

- Rating biases: identification of systematic bias like underestimation, overestimation, error…

- Other, as defined by user

- Generation of loan approval documentation: pricing, rating and approval documentation and more

Flexible and comprehensive reporting engine

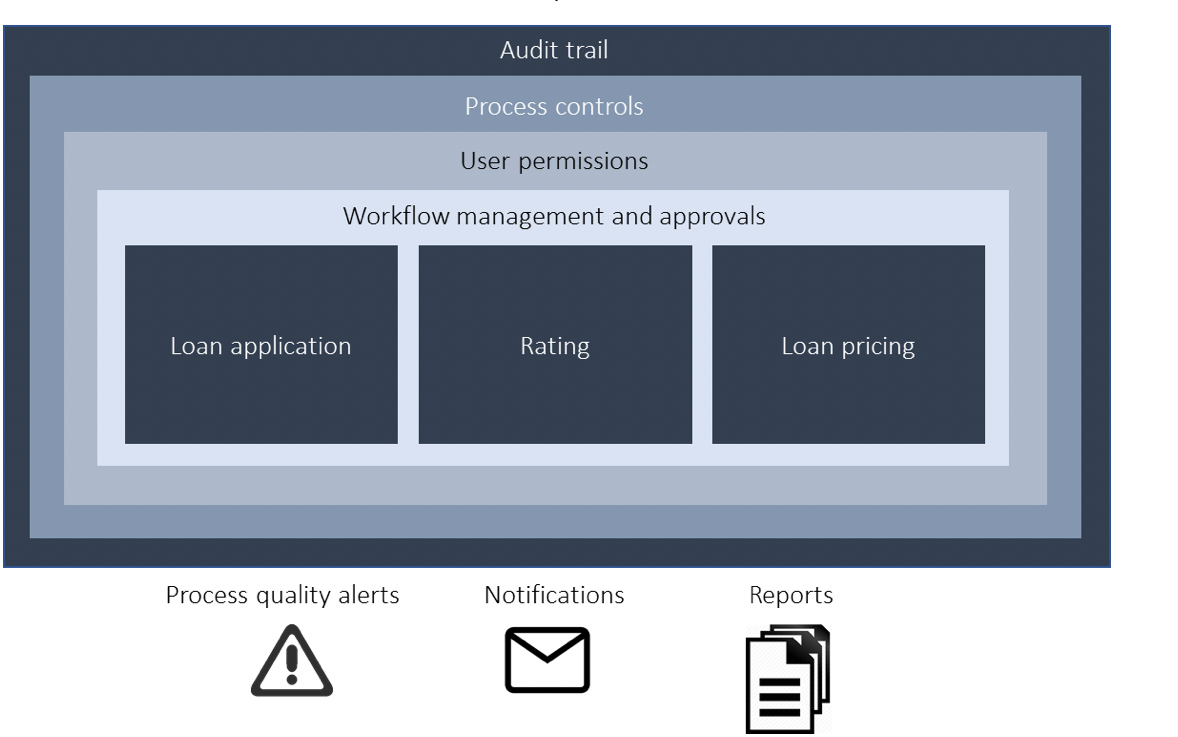

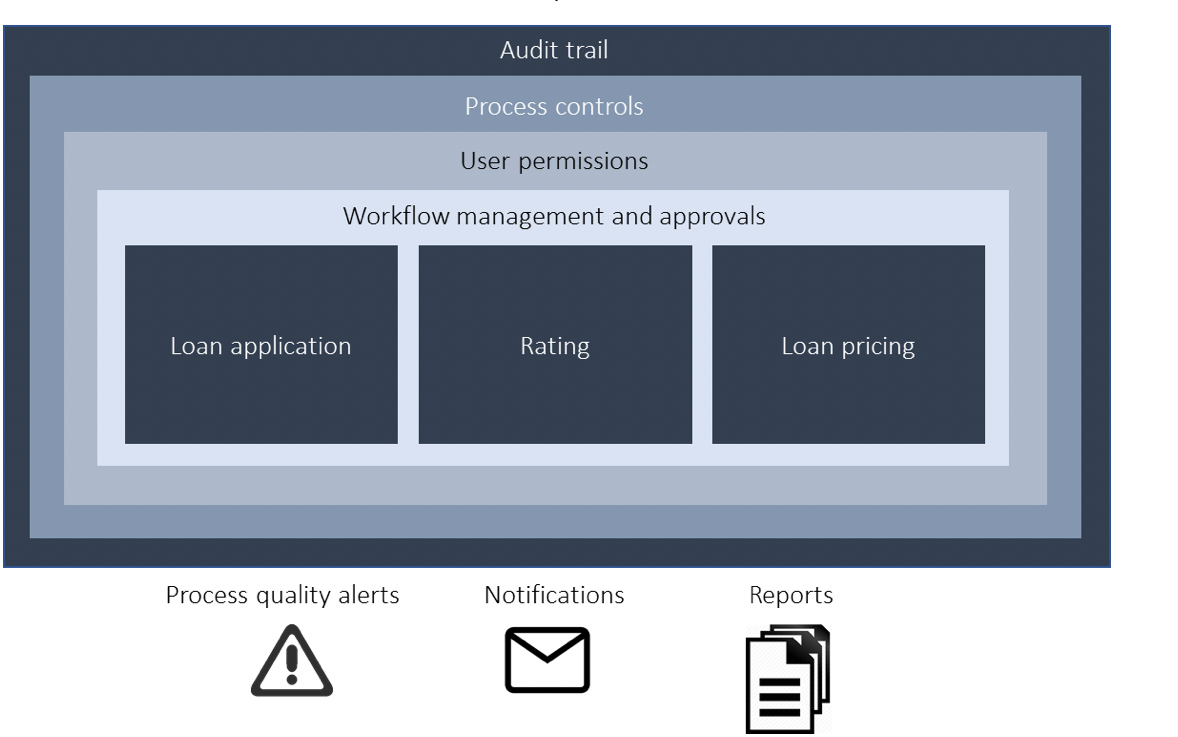

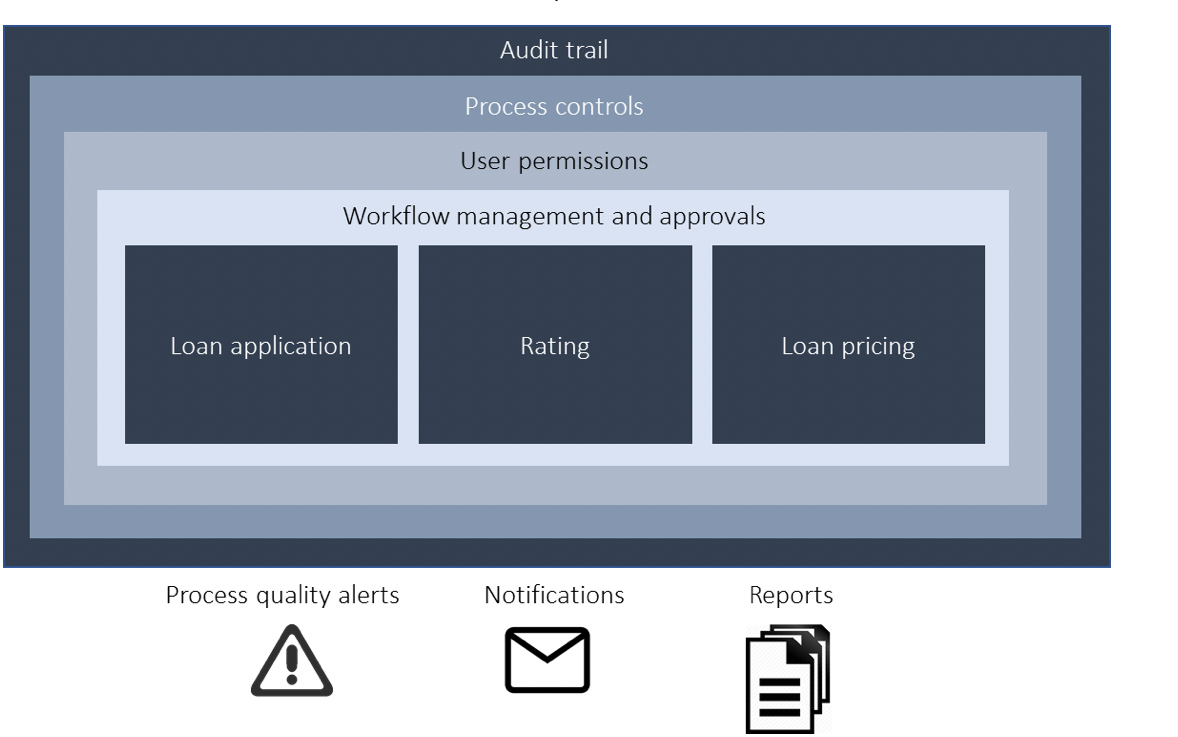

Internal governance for credit granting

- Workflow management and approvals: permits to build a customizable workflow embedding multiple potential approvals and control checks by different departments / functions

- User permissions: users can be assigned very specific permissions into workflow steps, tool menus / functions, reports and so on

- Process controls: each workflow step may incorporate controls such as the existence of a rating before pricing, permission for editing or deleting or other as defined by the user

- Audit trail: every action is recorded in a log organized by user, date, facility, rating, application and so on. The log of actions can also be used for reporting purposes

- Process quality alerts: ACCELERIS automatically generates re-rating alerts or identifies rating overwrite and causes like potential biases

- Notifications: automatic notifications are sent when the loan application / rating / pricing tools change status and there are actions to be initiated consequently

- Reports: the centralized data repository can be used to generate exception reports, staff performance, identification of process bottlenecks and others

Customizable multilayer control framework